For a Federal Housing Administration (FHA) loan to be approved, a home has to meet more qualifications and standards than your average conventional loan.

The roof can’t leak, the wires can’t show, the floors can’t creek, the paint can’t crack… and the list goes on. and on.

As FHA appraisals are a bit more complex, real estate appraisers have to get additional certification to perform them. The real estate community usually simplifies whether or not a home will qualify for an FHA loan by whether or not it satisfies the 3 S’s: Safety, Soundness, and Security.

The First “S” is Safety.

In FHA terms, “Safety refers to the health, habitability and sanitary condition of the property.” The majority of properties that fail an FHA appraisal do so because they aren’t safe. This applies to places in the home that could potentially harm it’s occupants. Here are just a few of the most common safety hazards that cause homes to fail an FHA appraisal:

- Chipping or peeling paint in homes built before 1978

To pass an FHA inspection, chipping paint like this won’t fly.

- Damaged or missing handrails on stairs, decks, etc.

- Exposed electrical wiring (anywhere)

- Missing carbon monoxide and smoke detectors

- Mold or rot anywhere in the home

- Utilities not being safely grounded

- Outdated well or septic systems

- Poor topography (such as a yard that doesn’t divert water flow away from the house, or a large ditch in the back yard)

- Signs of termite infestation

The biggest question you can ask yourself when it comes to the safety test is this: would I feel comfortable letting my kids play in this home? If the answer is no, some repairs or remodeling might be in order.

The Second “S” is Security.

Security is strangely the most confusing of the S’s. We’ve read several posts discussing the 3 S’s across the internet that talk about locking doors, or windows that properly shut. In fact, there are many appraisers who get this wrong.

This is a big misinterpretation of what security means when referring to FHA. In this case, security really means whether or not the property could act as collateral for the FHA insurance- the property’s marketability. Some examples of things that could have a negative impact on a home’s marketability:

“So, you’re telling me the active volcano behind my home affects it’s security?”

If you’re home is near a:

-Major freeway

-Railroad tracks

-Landfill or hazardous waste site

-Sewage treatment plant

-Power plant

-An active volcano (why did you buy that house, anyway?)

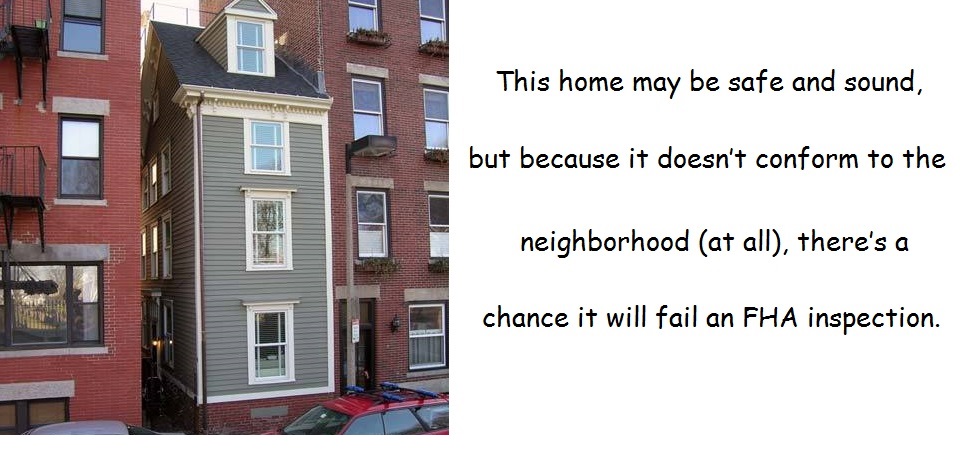

Security is really a question of whether or not there are any external factors that would keep the bank from selling your home if they happen to foreclose. This could be based on your homes location, whether or not your home conforms to the neighborhood, if it’s overbuilt, underbuilt … you get the idea. These things don’t immediately preclude a property from getting an FHA loan, however they are very large things for the appraiser to consider- especially when selecting comparable sales.

The Third “S” is Soundness.

This is basically a question of whether or not the property is structurally sound. When an appraiser encounters issues that apply here, they don’t necessarily require automatic repair to qualify for an FHA loan. Sometimes soundness issues only require further inspection or assessment from a professional who will then determine whether the issue warrants a repair or not. Appraisals and inspections are different. Some examples of soundness issues:

Foundation or structural cracks like this? That’s a big problem.

- Basement finishing or additions to the home that weren’t built correctly

- Visible cracks in the foundation or damage from settling

- Shifted or bowed walls

- Decks or porches that weren’t built to code

- Out-of-date roofing

- Additions or basement finishing that wasn’t properly built

- Insufficient insulation or ventilation in the attic

Something to remember: keep in mind we’re only talking about the FHA. There is a difference between what an appraiser the 3 S’s and minor deferred maintenance. An appraiser has to take note of smaller deficiencies in the property that definitely won’t do much to improve it’s value- but are not required to pass an FHA appraisal. Some examples:

- Cracked (but not broken) windows

- Lightly damaged walls

- Minor plumbing leaks

- Tripping hazards (cracked sidewalks/patios, poorly installed carpeting)

- Flickering lights

That’s the gist of the 3 S’s. If a none of these issues apply a property, it’s very likely it will pass an FHA inspection.

Jonathan Montgomery is the founder and president of the The Real Estate Appraisal Group, and has been a real estate professional since 1998. He has been a broker, an investor, and currently works full-time as an appraiser. He enjoys handling real estate appraisals in Washington D.C., Southern Maryland, and Northern Virginia.

Jonathan Montgomery is the founder and president of the The Real Estate Appraisal Group, and has been a real estate professional since 1998. He has been a broker, an investor, and currently works full-time as an appraiser. He enjoys handling real estate appraisals in Washington D.C., Southern Maryland, and Northern Virginia.

#TREAGroup #RealEstate #FHA

Recent Comments